The Fiduciary Standard in Risk Tolerance Assessment

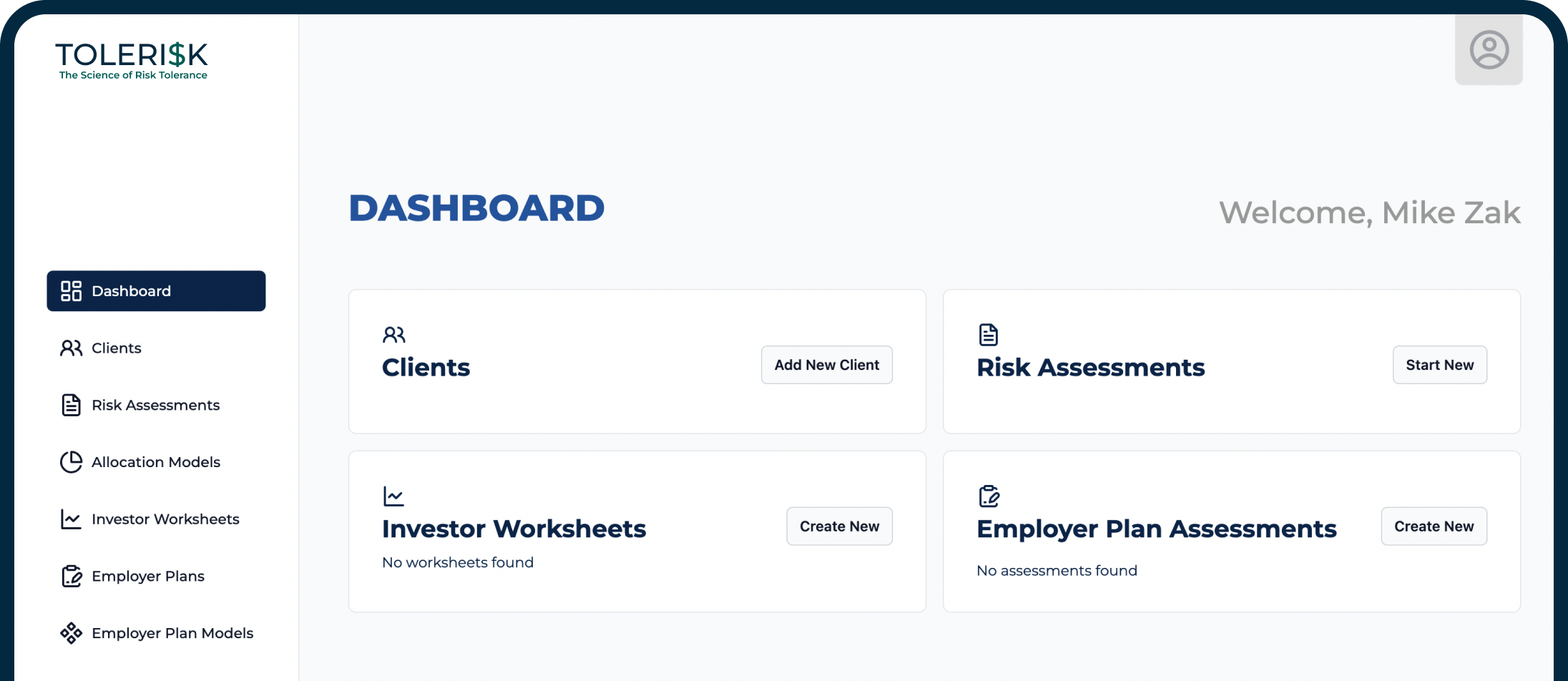

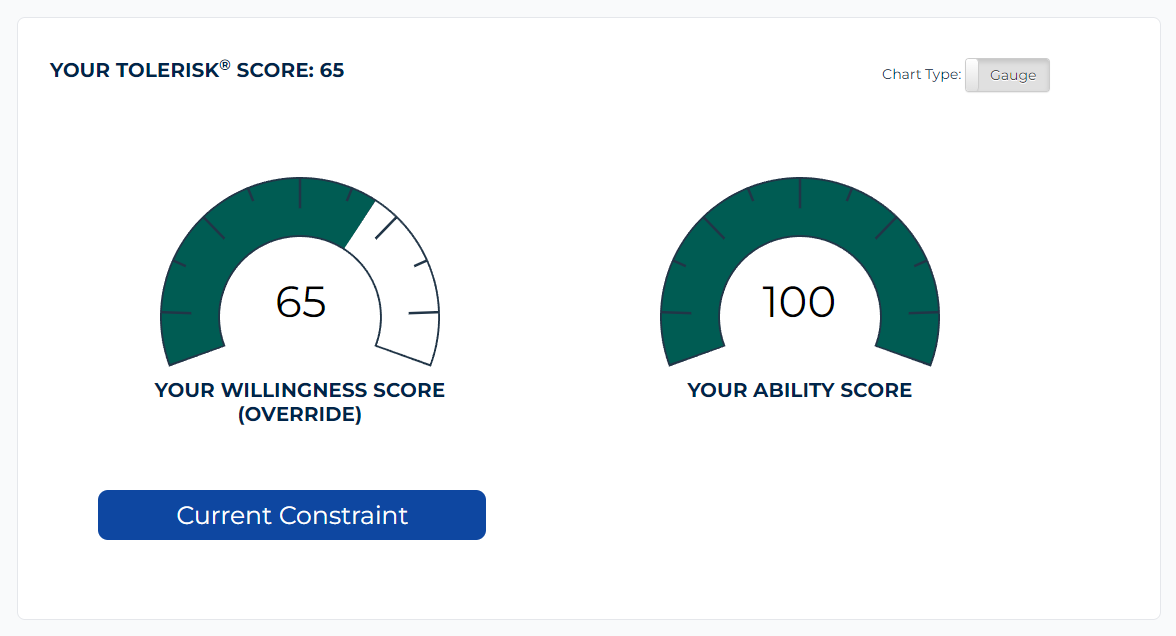

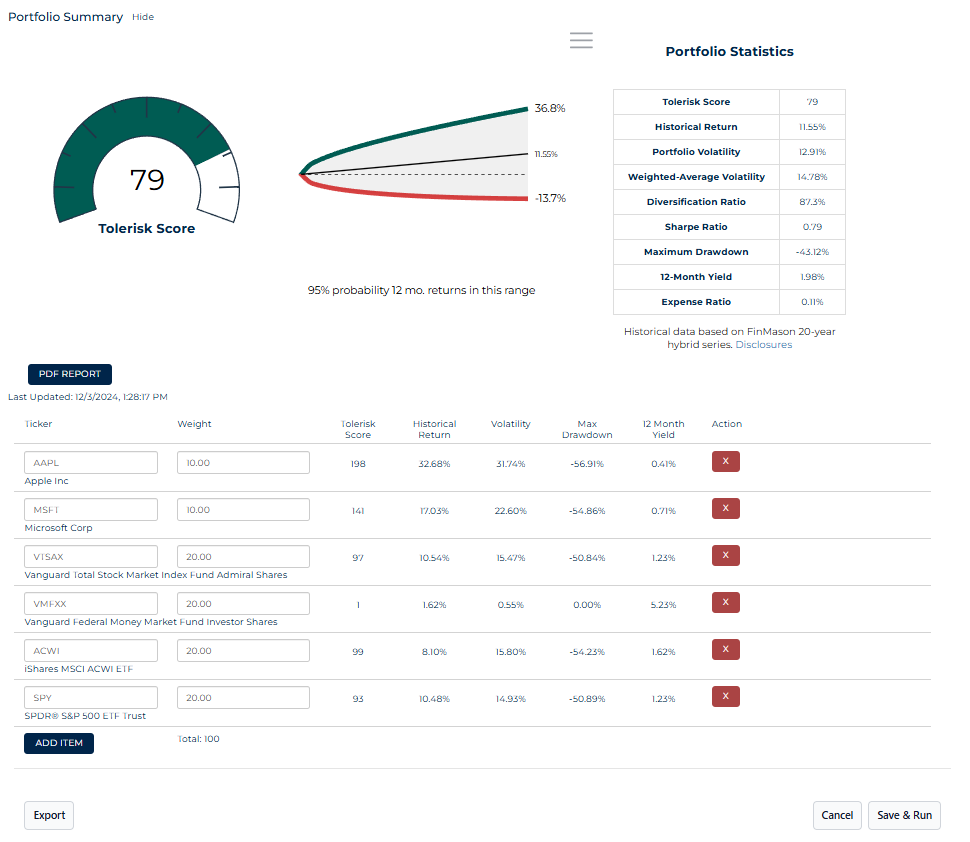

Risk tolerance technology designed for fiduciaries, Tolerisk accelerates practice growth and reduces compliance risk by making the complex easy for advisors to explain and for clients to understand.