About Us

Better technology helps separate the best financial advisors from the rest.

Great advice drives confident decisions and happy client outcomes.

Happy clients make the most successful advisors.

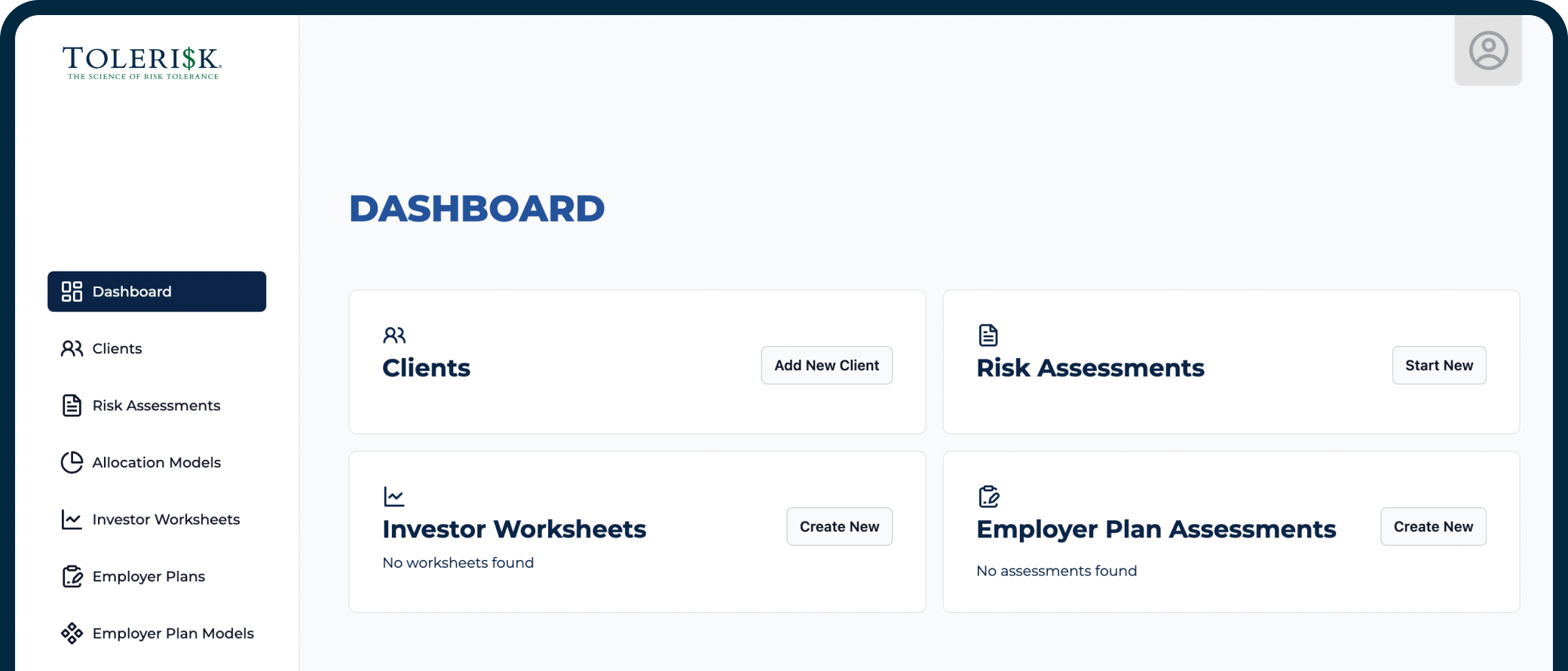

Tolerisk is the next-generation of user-friendly risk tolerance and financial planning analytics, designed for the fiduciary process.

Going beyond personality profiles, Tolerisk incorporates financial data to assess the client's unique risk capacity over time.

Our advanced analytics ensure proper risk alignment and monitoring, resulting in increased conversion, retention, and referrals through an objective, repeatable, and documented process.

Ultimately, Tolerisk simplifies complexity, accelerating practice growth and reducing compliance risk for advisors and clients.

Mark Friedenthal

Chief Executive Officer

Ryan Wheeler

Chief Technology Officer

Benjamin Mavy

Chief Revenue Officer

Our advisory board features accomplished industry leaders and experts, providing invaluable guidance for our strategic decisions and ensuring excellence in our endeavors.

Frank Anguiano

Head of Products - UBS

Brian Edelman

CEO - FCI

Nationally Recognized Cybersecurity Expert

Jonathan Jacobs

SVP - LIBRA Insurance

SVP - Crump Life (2016 - 2020)

Miriam Lefkowitz

Sr. Legal/Compliance Expert

General Counsel/CCO for RIA/BD (2002 - 2019)

SEC Sr. Counsel (1999 - 2002)

Michael Raneri

CTO - Voya Financial

Chief of Digital Innovation - AssetMark (2019-2022)

David Ritchey

DVP - Symetra

Sr. Investment Strategy Advisor – SS&C (2013- 2022)

Colin Slabach

Faculty Lead - NYU MS in Financial Planning

Edward Walters

COO - Osaic

Senior VP - Lincoln Financial Group (2019-2022)

Kelly Waltrich

CEO - Intention.ly

CMO - Orion (2017 - 2021)

CMO - eMoney (2013 - 2017)

Michael Zebrowski

COO - Docupace

EMD - Envestnet/ AI Labs (2016 – 2022)

COO - eMoney (2006 - 2016)