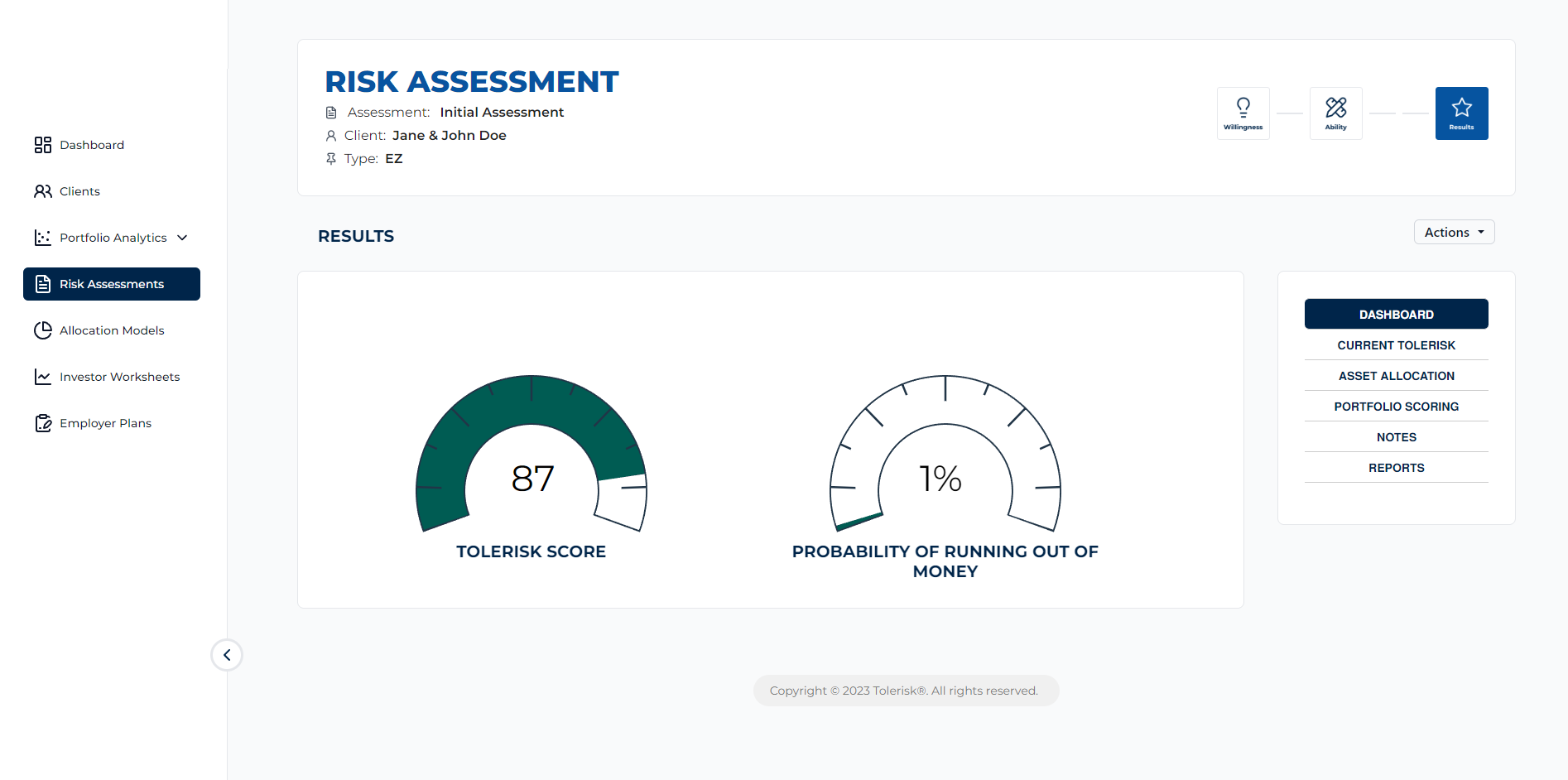

Risk Tolerance Assessment Software

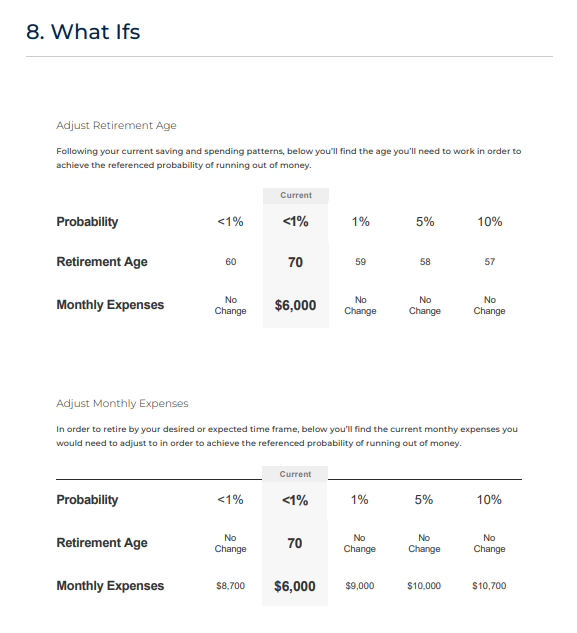

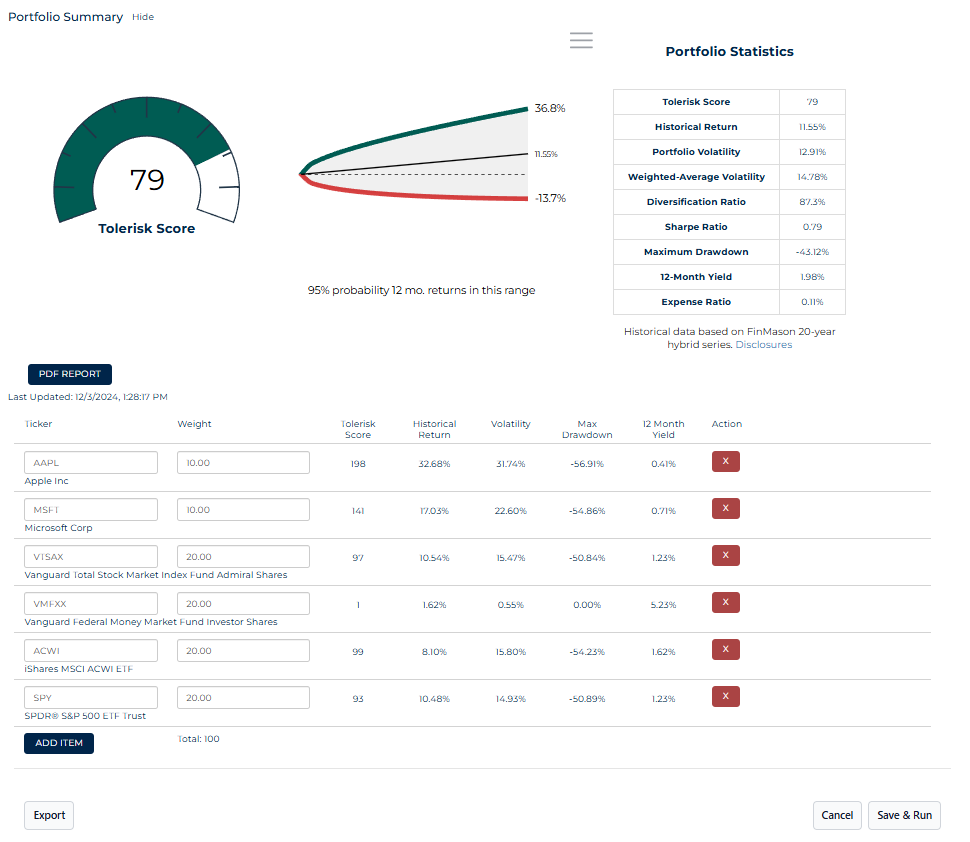

Tolerisk is risk tolerance technology for investment advisors, designed specifically for the fiduciary process. Our key differentiators produce more robust and realistic results, facilitating better decisions and more confidence by advisors and clients alike. This drives greater retention and more client referrals.