The Tolerisk AI Companion brings intelligent, contextual client interactions to your practice. Built to understand each client’s risk profile and communication preferences, it helps you maintain a personalized experience at scale, without adding to your workload.

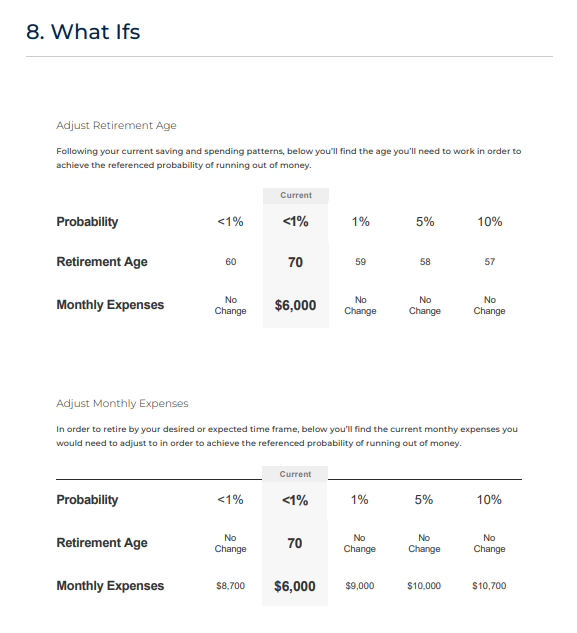

Instead of generic check-ins, the AI Companion conducts intelligent conversations by voice or text, grounded in a client’s prior responses and financial context. It surfaces meaningful life changes, flags when attention is needed, and keeps every interaction documented.

-

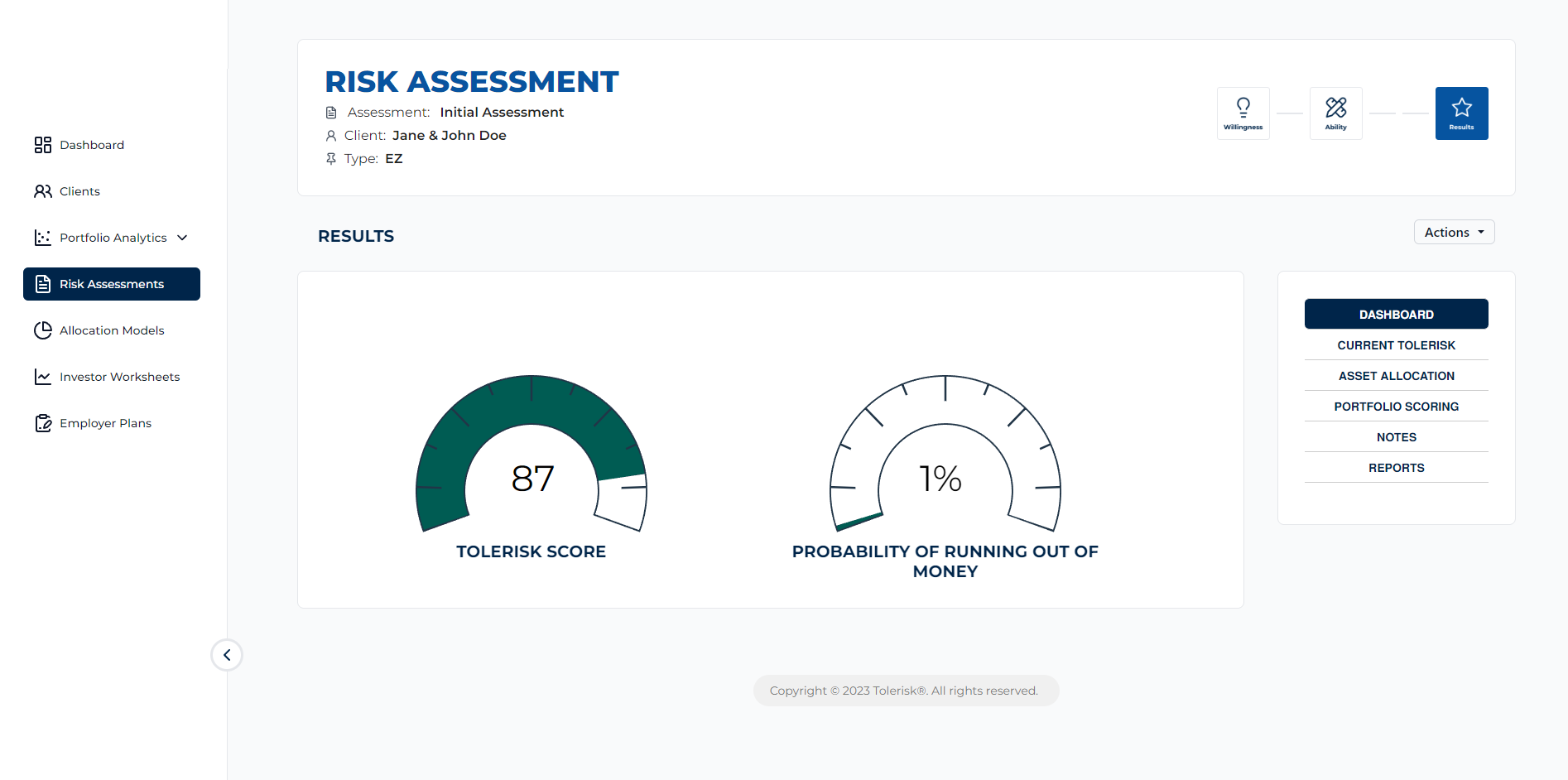

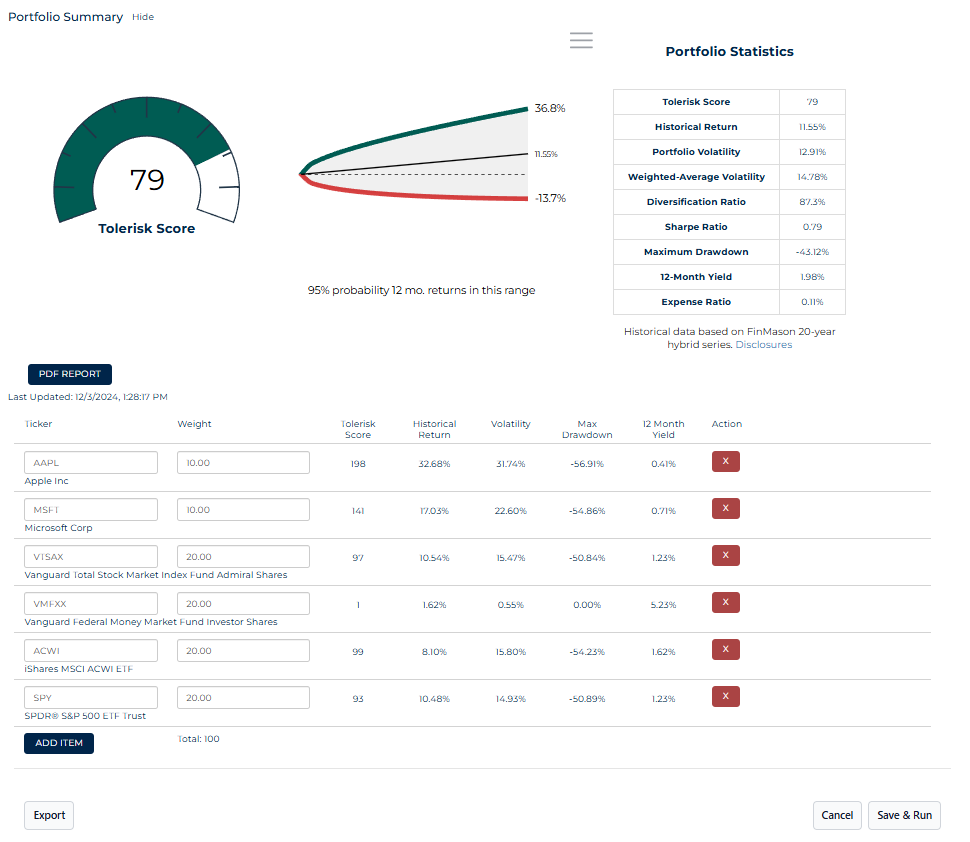

Grounded in past Tolerisk assessments: Conversations are informed by historical risk scores and assessment data

-

Ongoing, personalized engagement: Intelligent check-ins that evolve as the client evolves

-

Advisor-first and compliant: You stay in control, with full visibility and documentation