Should You Include Social Security in Your Financial Plan?

22 January 2019

The future of Social Security in the United States is hotly contested. Both current and future retirees are concerned that the retirement income they’ve been promised won’t be there and should be excluded from financial plans. We’re going to examine the current state of affairs as well as some of the popular notions of Social Security reform. Will the likely changes, if they occur, be enough to secure the future of Social Security?

The current state of affairs

Social Security brings in revenue in the form of taxes on wage earners. Employees and employers each contribute 6.2 percent of employee wages, for a total of 12.4 percent. This is the primary source of funding for Social Security’s main expense, the monthly income benefit paid to retirees. When revenues exceed expenses, as has been the case generally for many years, the surplus is invested in U.S. Treasury securities, collectively known as the Social Security Trust Fund. Currently that Trust Fund stands at $2,892 billion. That portfolio of treasury securities also generates interest, which serves as a secondary source of revenue for the Social Security system. Total revenue for the Social Security system in 2017 was $997 billion, of which $874 billion came from taxes on wages, $38 billion from benefit taxes, and $85 billion from interest on the Trust Fund.

While the numbers sound promising, the problem generally lies in the population’s shifting demographic. Baby boomers are beginning to retire, and this combined with progressively longer lifespans means the ratio of workers to retirees is declining.,. As of 2018, there will no longer be an annual surplus, but rather an annual deficit as the amount paid in benefits exceeds the revenues for Social Security, with the shortfall currently being covered by interest on the Trust Fund. The deficit is projected to grow year by year if the current system remains unchanged, with the Trust Fund facing complete depletion by 2034.. At that point, the projected revenues will be about 79 percent of the total expenses of the system and Social Security would NOT be able to fulfill its stated obligation.

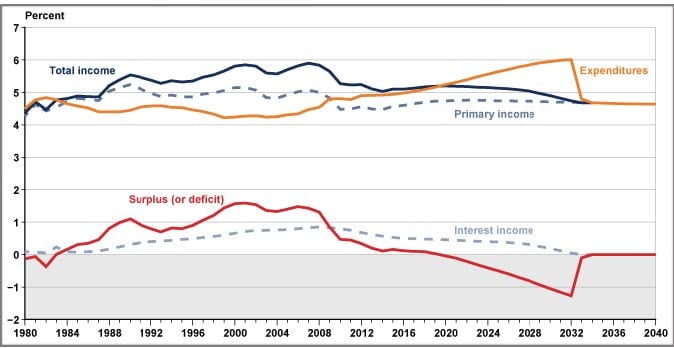

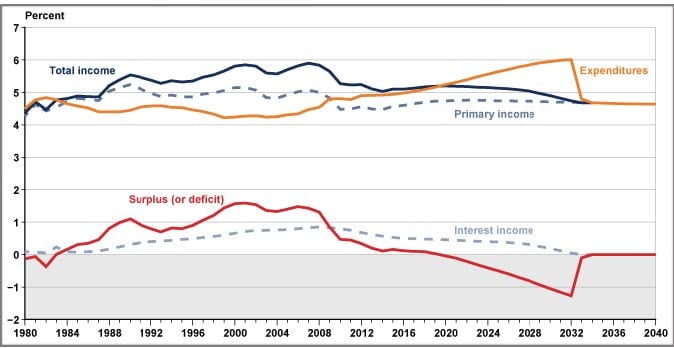

https://www.ssa.gov/policy/docs/ssb/v75n1/v75n1p1.html (Chart)

(Chart 1 shows Trust Fund total income exceeding Trust Fund expenditures from 1984 through 2017, generating annual surpluses. Beginning in 2018, total income is projected to be less than expenditures, generating annual deficits (shown as negative surpluses).

Now, this would be a pretty disastrous situation for many Americans who rely on their Social Security checks, thus causing the current widespread fear. However, contrary to popular misconceptions, this would not actually be the end of the Social Security system because the majority of its funding would still be covered by revenue from those still working. It would mean that as of 2034, either all benefits would be cut by approximately 21% or some people would not receive those benefits and others would receive more than 79% of their stated benefits.

Let’s examine some of the popular proposals to remediate the failing Social Security System.

- Increase the age of full retirement for younger workers. This is perhaps the most intuitive solution to many simply because people are living longer and healthier lives, enabling them to work longer and still have a lengthy retirement. When Social Security was first enacted in 1935, the average life expectancy of a newborn was 61. In 2017, the average life expectancy of a newborn [in the U.S.] is 78.5 yrs. Perhaps a more meaningful statistic is the change in life expectancy of someone at full retirement age (FRA). In 1935, a 65-year-old had a life expectancy of 78 yrs. In 2016, a 67-year-old (full retirement age for those born after 1960) had a life expectancy of 84. So the eligible age for full retirement has only increased by two years (from 65 to 67), while the average lifespan for a 65-year old has increased by six years (from 13 to 17), meaning only one-third of the increase in life expectancy is being accounted for! In 1983, the full retirement age of 67 for Social Security benefits was officially enacted after a gradual implementation over 22 yrs. This was done slowly to protect those getting close to retirement and only create a small impact for those a few more years away from retirement. If further increases to the full retirement age are enacted, it seems likely that a similar, gradual approach would be taken. Perhaps an FRA of 68 (+2 mo/yr) for those born between 1966-71, FRA of 69 (+2 mo/yr) for those born between 1972-77 and FRA of 70 for those born after 1978. This would likely create a benefit reduction (if claimed at minimum age) of 45 percent at an FRA of 70 years compared to 25 percent for an FRA of 66 and 30 percent for an FRA of 67.

- Increase the cap on wages on which Social Security is taxed. While this would increase revenues for Social Security, it would also increase future expenses, as benefits have historically been limited by the same cap. However, the Social Security benefit formula only includes 15 percent of the wages earned above $5,397/mo, which is far below the cap of $10,700/mo in 2018. Eliminating the tax cap would solve approximately 30 percent of the anticipated shortfall in Social Security over the next 75 years.

- Increase the percentage taxed on wages to pay for Social Security. Covering the shortfall would necessitate an increase now of 2 percent. If we wait until 2034, the increase in taxes would have to be 3.3 percent to reach a total of approximately 15.7 percent, as the current 12.4 percent rate is only projected to cover 79 percent of Social Security’s expenditures when its reserves run out.

- Decrease current or future planned benefits. A 13 percent overall benefit cut would solve 75 years of the shortfall, or the government could wait until 2033 and then slash benefits by 21-23 percent.

- Means test benefits. Reducing benefits for those with a high income in retirement is a popular proposal among some, who believe that those with greater income in retirement don’t need Social Security. This is a complex proposal for several reasons. First, some legal experts believe that the implied covenant between workers contributing to Social Security and the U.S. government is that they would receive those benefits upon retirement. Others believe that not providing the stated benefit would violate this agreement. Now, one could make a similar argument that simply delaying full retirement could also constitute a breach of agreement. So, let’s look at the practical impact of Means Testing. If those with retirement income above the cap of $256,800 (2018’s wage base cap x 2; married couples) received no benefit, this would equate to approximately 1 percent of retirees whose taxable income exceeded the taxable wage cap. Because of the small population of high-income retirees, this is expected to only cover approximately 10 percent of the shortfall if it were enacted immediately, and the impact if enacted years down the road would be even smaller.

Conclusions

From a financial planning perspective, only one of the solutions above would cause an elimination of benefits, which would only potentially apply to a small number of clients (approximately 61 million receive Social Security, but only 1 percent are top earners, which would result in about 600,000 eliminated beneficiaries). To generate $250,000 in taxable income, a retired married couple would have to have dividend and interest income on a portfolio of roughly $10 million [2.50% x $10 million = $250,000) or have a traditional IRA required minimum distribution (RMD) on a portfolio of roughly $5 million (250k/27.4 yrs = $9124.09 RMD). Since this cap has historically increased with inflation, those portfolio sizes represent today’s dollars for general magnitude.

For most of America, the absolute worst case regarding Social Security would be if nothing is done and they received only 79 percent (decreasing to 73 percent over 75 years) of their promised benefit. Since there are a number of seemingly reasonable alternatives to this scenario, it appears that situation is unlikely. However, clients looking to be extremely conservative in their planning could choose to plan for only 79 percent of their stated benefit. It seems clear that removing Social Security altogether from the plan would be too conservative for all but the wealthiest Americans.

As with many solutions, the most likely event here may be a combination of adjustments. Increasing the retirement age gradually on today’s younger workers may be the most palatable. The more delayed this change is, the more likely other supplemental changes may also have to be included, such as an increased cap on wages taxed or an actual increase in the tax rate itself. Since means testing doesn’t actually cover a large portion of the shortfall, it may be less likely to be part of the equation.

The bottom line is that the Social Security system may be in dire need of reform, but it’s not going away.

What should advisors actually DO when it comes to financial plans for clients?

- Delay the expected age of full retirement for clients under 50 without increasing expected benefits. (Note that in 1983 individuals with fewer than 20 years until full retirement were spared any delays). Delaying a year for every 6 years younger than 50 is both practical (2 months for each year later someone was born was the formula used in 1983, although there was a hiatus for those born between 1943 and 1954) and realistic. For example, expect a 44-year old would have full retirement age of 68 and a 38-year old would be delayed to 69, while those 32 or under would have a full retirement age of 70.

- Exclude Social Security for those with likely taxable income of $250k (present value) or more in retirement. This is likely a client with $10mm+ in taxable assets or $5mm+ in traditional IRA/401k assets, or substantial defined benefit pension income or other taxable income sources. Don’t forget to adjust for inflation, meaning in 28 years (@ 2.5% inflation) that annual income threshold would likely be something more like $500k/yr. For those clients in this situation, it may be prudent to exclude social security benefits to ensure that they can sustain their lifestyle, even without Social Security benefits.

1 “Trust Funds Summary.” SSA. Accessed August 01, 2018.

https://www.ssa.gov/policy/trust-funds-summary.html

2 Ibid

3 Ibid

4 Ibid

5 Ibid

6 Dinan, Stephen. “Social Security Now Running a Deficit; Insolvency Set at 2034.” The Washington Times. June 05, 2018. Accessed August 01, 2018.

https://www.washingtontimes.com/news/2018/jun/5/social-security-now-running-deficit/

7 “Trust Funds Summary.” SSA. Accessed August 01, 2018.

https://www.ssa.gov/policy/trust-funds-summary.html

8 Ibid

9 Max, Sarah. “Will Social Security Really Run Out of Money? | Money.” Time. March 21, 2016. Accessed August 01, 2018. http://time.com/money/4213065/will-social-security-run-out-money/.

10 “Social Security History.” SSA. Accessed August 01, 2018. https://www.ssa.gov/history/orghist.html.

11 Escamilla, Javier. “The Social Security Dilemma.” Stanford.edu. Accessed August 01, 2018. https://web.stanford.edu/class/e297c/poverty_prejudice/soc_sec/hsocialsec.htm.

12 “Life Expectancy in North America in 2017 | Statistic.” Statista. Accessed August 01, 2018. https://www.statista.com/statistics/274513/life-expectancy-in-north-america/.

13 “Social Security.” SSA. Accessed August 01, 2018. https://www.ssa.gov/history/lifeexpect.html.

14 “Benefits Planner: Retirement.” SSA. Accessed August 01, 2018. https://www.ssa.gov/planners/retire/1960.html.

15 “Life Expectancy Tables.” Life Expectancy Calculators. Accessed August 01, 2018. https://www.lifeexpectancycalculators.com/actuarial-life-tables.html.

16 “Benefits Planner: Retirement.” SSA. Accessed August 01, 2018. https://www.ssa.gov/planners/retire/background.html.

17 Ibid

18 “Raise the Full Retirement Age for Social Security.” Congressional Budget Office. Accessed August 01, 2018. https://www.cbo.gov/budget-options/2016/52186.

19 Ibid

20 Ibid

21 Moeller, Philip. “Should We Raise the Retirement Age for Social Security and Medicare?” PBS. February 01, 2017. Accessed August 01, 2018. https://www.pbs.org/newshour/economy/raise-retirement-age-social-security-medicare.

22 “Your Retirement Benefit: How It’s Figured.” SSA. https://www.ssa.gov/pubs/EN-05-10070.pdf.

23 “Social Security Administration Announces Small Increase in 2018 Wage Base.” Journal of Accountancy. October 13, 2017. Accessed August 01, 2018. https://www.journalofaccountancy.com/news/2017/oct/social-security-wage-base-2018-201717654.html.

24 Sass, Steven A., Alicia Haydock. Munnell, and Andrew Eschtruth. The Social Security Fix-it Book: A Citizens Guide. Chestnut Hill, MA: Center for Retirement Research at Boston College, 2007.

25 Ibid

26 Correia, Margarida. “Social Security Trust Fund Reserves on Track to Be Depleted by 2034.” Bank Investment Consultant. June 05, 2018. Accessed August 01, 2018. https://bic.financial-planning.com/news/social-security-trust-fund-reserves-on-track-to-be-depleted-by-2034.

27 Sass, Steven A., Alicia Haydock. Munnell, and Andrew Eschtruth. The Social Security Fix-it Book: A Citizens Guide. Chestnut Hill, MA: Center for Retirement Research at Boston College, 2007.

28 Ibid

29 Ibid

30 Bell, Kay. “IRA Required Minimum Distributions Table.” Bankrate. January 09, 2012. Accessed August 01, 2018. https://www.bankrate.com/finance/money-guides/ira-minimum-distributions-table.aspx.

31 Max, Sarah. “Will Social Security Really Run Out of Money? | Money.” Time. March 21, 2016. Accessed August 01, 2018. http://time.com/money/4213065/will-social-security-run-out-money/.

32 Ibid